These Post office investment schemes are risk-free and easily accessible with a government guarantee. Some of the schemes also offer tax benefits under Section 80C of the Income Tax Act.

Popular schemes offer interest rates of up to 8.2 per cent. (Post Office Investment Schemes 2025)

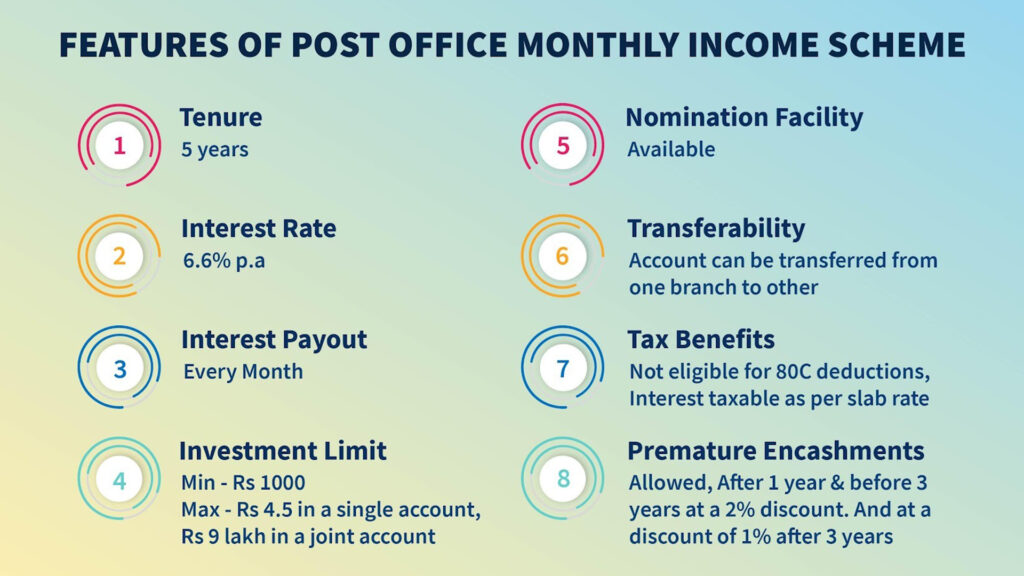

Post Office Monthly Income Scheme (POMIS)

A one-time investment in Post Office Monthly Income Scheme (POMIS) can earn interest every month. Rs. You can invest from Rs 100 to Rs 1000. The maximum limit is Rs. 9 lakh. This scheme has to wait for 1 year for early closure, then there will be only a small penalty.

Kisan Vikas Patra (KVP) (Post Office Investment Schemes 2025)

A simple and secure scheme. Your money will double over a period of time. 7.5% per annum and a minimum of Rs. You can start with 1,000. This is a good option to grow money in the long run without risk.

Sukanya Samriddhi Yojana (SSY)

Specially designed for the girl child. 8.2 per cent per annum. You can invest up to Rs 1.5 lakh. It also has tax benefits under Section 80C. A plan for my daughter’s future.

Senior Citizens Savings Scheme (SCSS)

A retirement plan designed specifically for senior citizens. The scheme gives an annual interest of 8.2 per cent, which is paid every three months, i.e. interest is accrued once every quarter instead of monthly. You can deposit a maximum of ₹30 lakh in each account in multiples of ₹1,000. This plan provides a stable income to senior citizens, and also has tax benefits, which means that you can get some kind of tax benefits on the money you put in.

National Savings Certificate (NSC) (Post Office Investment Schemes 2025)

A 5-year fixed deposit-like savings plan. Its interest rate is 7.70% per annum, which is compounded every year. That is, the interest that you get will also be included as an investment again, thereby increasing the total income. At least Rs. You can start with ,000, and there’s no maximum limit, which means you can put in as much as you want. Since it is an NSC-secured plan, your money is safe. Additionally, it also offers a tax-saving option under Section 80C of the Income Tax Act, which means you can get a tax deduction on the entire money you put in.

Recurring Deposit (RD)

You can start investing with Rs 100 and get an interest rate of 6.70 per cent. Loan up to 50% can be taken after 12 months. Pre-closure after 3 years, with reduced rate.

Public Provident Fund (PPF) is a long-term, tax-free savings scheme. 7.10 per cent per annum. Rs. 500. Investment up to Rs 1.5 lakh Maturity is 15 years. Interest + maturity amount is tax-free.

Post Office Savings Account

Simple savings account, 4% annual interest. Rs. Let’s start with 500. You can open an individual account or a joint account. A safe, easy way to park money. For safety, stable interest and peace of mind, post office schemes are the best. PPF tax-free, SCSS senior-friendly income, SSY girl-child focus, all these are easy, risk-free options for your future. With an interest rate of up to 8.2%, a secure financial future can be built even through small savings.